Hey there, are you in search of some valuable insights on insurance coverage for dental implants?

Well, you just landed in the right place!

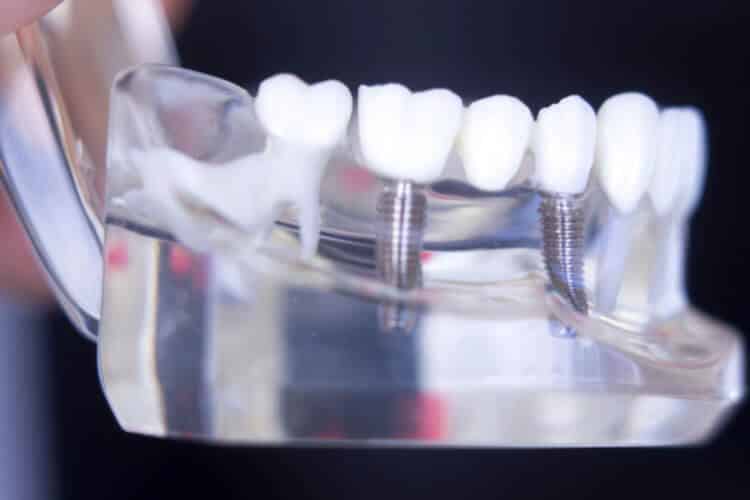

In recent years, dental implants have become a go-to choice for replacing missing teeth—thanks to their high success rate and the comfort they offer. However, one stumbling block that many encounter is understanding what insurance coverage entails in this regard.

In our forthcoming enlightening piece, we’ll walk you through the importance of dental insurance, explain its intricate features, and unmask the specifics on how different insurance policies work towards dental implants.

We aim to provide an extensive guide that will empower you with the knowledge you need about dental insurance coverage for implants—removing the clouds of confusion and helping you make an informed decision.

After all, everyone deserves a worry-free and confident smile! So, buckle up and join us on this illuminating journey.

Let’s dive in, shall we?

Table of Contents

Growing Prevalence of Dental Implants

Have you noticed an upward trend in the number of people sporting shiny, new dental implants?

You’re not alone!

We’ve been keeping tabs on the burgeoning dental implant industry and it’s safe to say it’s booming.

If you’re anything like us – always craving to be ahead of the curve and have a deep-rooted connection with your pearly whites – you’ve hit the jackpot because we’ll be delving into all things dental implants.

Global Market Trends

At the heart of this phenomenon is the incredible technological strides the industry is making.

Each year, we’re seeing a 6% to 23% surge in dental implant trends. That’s a lot of gleaming smiles!

According to expert predictions, the global dental implant market is set to reach a whopping $13 billion by 2023, indicating a healthy 14% annual rise in dental implant prevalence.

Go ahead, let that sink in.

Perhaps it’s time you checked out the Advancements of Dental Implants in 2023?

Private vs Public Insurance Coverage

As the market continues to thrive, it’s no surprise that a pertinent question arises: who’s footing the bill?

There’s an inherent dichotomy that exists between private and public, and that line is often blurred when it comes to insurance.

Hence, it becomes crucial for you to understand what you’re diving into before you take the plunge. In our next sections, we’ll breach the surface of this topic, discussing the ins and outs of private versus public insurance coverage for dental implants.

Do make sure to watch this space so you can stride with us on this enlightening journey, becoming more informed about dental implant trends and making smart, tooth-friendly decisions!

So, what are you waiting for? Grab a toothbrush, and let’s dive in! 😉

Alright, dental enthusiasts, that’s a wrap for now. We’ve served these bite-sized morsels of information up for you – make sure to digest them well. Until next time, keep flashing those pearly whites and remember, knowledge is power, especially when it comes to your smile.

Features of Dental Insurance Plans Covering Implants

Are you contemplating getting dental implants but daunted by the cost?

Hear us out; dental insurance plans can be your knight in shining armor!

These policies are tailored to lessen the financial dent associated with such procedures, making your pathway to a perfect smile more accessible and affordable.

But, insurance policies can be complex, so we’re here to break down the key elements to look out for in dental insurance plans that cover implants.

Roll-Over Maximums

Who doesn’t like an extra scoop of ice cream? 🍨

It’s similar with dental insurance—some of the top-quality ones offer a feature called ‘roll-over maximums’.

This system means that if you don’t exhaust your annual maximum limit, the unused portion rolls over to the next year.

So, if an unexpected requirement for a dental implant arises, you have a cushion of extra funds at your disposal.

This feature can be a game-changer in managing your dental health expenditure.

Preventive and Diagnostic Credit

Prevention is better than cure, they say, and some dental insurance plans live by this mantra.

These forward-thinking policies provide a ‘preventive and diagnostic credit’ that covers regular check-ups and preventive procedures, included in its implant coverage. The idea is to take care of minute issues before they transform into larger problems requiring implants.

Periodic exams, routine cleanings, and X-rays fall under this credit, helping you maintain your oral health without further denting your wallet.

Coverage Rates

The coverage rate is another crucial aspect to be mindful of when selecting a dental insurance plan.

While some cover 100% of preventative care, the percentage can decrease for basic procedures, and even more so for major treatments like implants.

Typically, implant treatments might be covered at around 50% – but remember, half a pie is better than no pie at all.

Waiting Periods

Alright, you’ve got your insurance policy in place, ready to flash your perfect smile – but wait! 🔍

You might be forgetting about the lurking ‘waiting periods.’ Many dental insurance plans enforce a waiting period before you can avail certain procedures like dental implants.

This period can range from a few months to a full year, demanding patience before you can utilize your insurance benefits fully.

Dental insurance plans that cover implants indeed come with tons of perks.

But, remember, it’s imperative to understand their features entirely before making a choice.

After all, we always check the flavor before buying that tub of ice cream, don’t we? 🍦

Insurance Company Policies and Coverages

Understanding the various insurance company policies and the coverages they offer can often feel like navigating through a complex maze.

It can be downright overwhelming. But, fear not!

We’re here to shed some light on what some of the key insurance players like Delta Dental Premier, Medicare, Cigna, Aflac, Guardian, and MetLife VADIP have in their offing.

We’ll be focusing specially on their respective policies concerning dental implants.

Delta Dental Premier

Delta Dental Premier offers its esteemed customers a mouthful of coverage for dental implants. This generous provision makes them a prime choice for those considering dental implants as a solution to their dental woes.

Trust us when we say, Delta Dental Premier really has your back…err, we mean teeth! 😀

Medicare

No stranger to the insurance game, Medicare also provides impressive options.

However, it’s important to keep in mind that about 10% of Medicare patients have a coinsurance rate of 50% for major dental services. That could certainly be a bargain for some! 🤓

Cigna, Aflac, Guardian

Now, let’s turn our attention to this powerful trio: Cigna, Aflac, and Guardian.

All three companies are renowned insurance providers with a proven track record for customer satisfaction. And, to top it all off, what do Cigna, Aflac, and Guardian all have in common other than their stellar reputations?

You guessed it – they all cover dental implants! A win, win, win situation indeed!

MetLife VADIP

Last, but definitely not least, let’s talk about the savior of our veterans, the MetLife Veterans Affairs Dental Insurance Program or VADIP.

Their plans offer a comprehensive cover for veterans needing implants. Now, that’s a policy with a heart!❤️

In the insurance battlefield loaded with options, it’s critical to know and compare the different policies and coverages available.

While we have spoken about the dental implant coverage provided by these insurance companies, remember that there are several other factors to consider before signing on the dotted line.

So, whether you’re needing dental implant coverage or shopping around for an insurance policy designed to have you covered head to toe, we hope this overview assists in making your insurance decision process a little less daunting!

Now, who said understanding insurance should be like pulling teeth?😉

The Complexities and Variabilities of Coverage

Embarking on the journey for a perfect, radiant smile with dental implants?

Excellent, you might want to buckle up as it’s not just about medical procedures, but also how your treatment aligns with your insurance coverage.

Dental implant insurance coverage is a complex universe requiring an understanding of classification, coverage rates, and approval conditions.

Insurance Classification of Implants

Upon venturing into this universe, the first stencil in your fortuitous star chart is how insurance agencies classify dental implants.

Have you ever found yourself thinking, “Are dental implants cosmetic or essential?

Well, the answer isn’t straightforward, as it depends on your insurance provider’s policy.

Some insurers classify dental implants under essential dentistry, while others categorize it under cosmetic dentistry.

- Essential dentistry: Here, dental implants are seen as necessary for your oral health. In this case, you’re likely to enjoy more financial support from your insurance.

- Cosmetic dentistry: When tagged under this category, dental implants are deemed less of a medical need and more of an aesthetic desire. In this situation, insurance support can, unfortunately, be lower or even non-existent.

Coverage Rates

Now, navigating to the cornerstone of this cosmos – the coverage rates.

How much your insurance plan covers plays a significant role in estimating the out-of-pocket expenses for dental implants. 📘

From our experience, dental implant coverage varies between 30% to 50% under most insurance plans.

However, it’s essential that you ensure this with your insurance provider, as they have the final say.

Conditions for Approval

Lastly, but definitely not least, let’s step into the orbit of conditions for approval.

The reasons behind needing dental implants can greatly influence whether your insurance company will approve the coverage. One key condition worth highlighting is the cause leading to the requirement of the implant!

For instance, dental impairment due to an unforeseen accident 🔨 or severe damage could augment your chances of getting approval for coverage.

While understanding your dental implant coverage can seem daunting, this breakthrough might just be your stepping stone into your journey towards a bright, confident, and insured smile!

Remember, the key to this journey lies in asking the right questions – from understanding how your insurer classifies dental implants to knowing your expected coverage, and the conditions affecting approval. When speaking with your insurer, don’t forget to review these points – it might make the path seem less like a complex universe and more like a navigable roadmap. 🗺️ 🛤️

The Trending Shift in Insurance Coverage

A revolution is brewing in the insurance sector and guess what?

It’s bringing a bucket load of reasons to flash that million-dollar smile — now more brilliantly than ever.

The world of insurance is experiencing a tangible shift and we’re here to spill all the delightful deets for you! 📚

Traditionally, insurance coverage in terms of dental health has been somewhat of a grey area. Many holders would grimace at the mere mention of the term ‘dental implants,’ and understandably so.

It was often synonymous with biting the bullet when it came to medical expenses. But the winds of change are blowing, friends, and they’re raising a refreshing dust storm in the insurance scape.

More recently, there’s been a rising trend among insurance providers to offer increased coverage for dental implants.

That’s right! What was once a distant dream is now becoming a tangible reality, and that’s some news worth celebrating. 🎉

Key Highlights:

- More insurance companies are now stepping forward to foot the bill for dental implants, at least partially.

- This paradigm shift in the insurance sector is shedding light on the growing importance of dental health.

- The move is encouraging more individuals to seek appropriate dental interventions, thereby promoting better overall health.

The pivot towards offering increased dental implant coverage is not just a landmark decision; it’s indicative of a broader trend to better cater to diverse healthcare needs. It indicates the industry’s growing acknowledgment that oral health is an integral part of overall well-being.

With insurance companies providing cover for dental implants, the broader territory of health coverage is innovating. The aim to make healthcare more accessible, comprehensive, and preventative is becoming more evident each day.

So, while we’re still on this journey towards healthcare transformation, one thing is sure — this shift in insurance coverage is definitely a leap in the right direction. 💪

This delightful shift is an equal opportunity for all of us to reassess insurance covers and ensure they serve our needs diligently. After all, oral health has a significant impact on our overall well-being, and its diligent care should be as commonplace as coverage for medical or surgical treatments.

So, let’s leverage this shifting trend and take proper care of our pearly whites, just as we would for the rest of our health needs! 🦷👍

Finally, it’s safe to say that with these major shifts in insurance coverage – adequate dental care is no longer just a dream but a reality that’s here to stay.

How refreshing is that? So, do keep an eye on these changes and remember, that dazzling smile of yours truly is worth every penny! 💰💖

Conclusion

Navigating the world of dental insurance can often feel overwhelming, particularly when trying to determine what is covered and what isn’t.

Yet, understanding your coverage is more important than ever, especially when it comes to costly procedures like dental implants. As our guide has shown, the degree and kind of coverage varies greatly across insurance providers.

While some plans might cover a portion of the cost, others may have stringent prerequisites for approval or exclude the treatment altogether. Insurance companies are gradually recognizing the long-term benefits of dental implants, leading to a gradual shift in coverage policies. We’re seeing an increasing number of providers offering at least partial cover for implants.

However, it’s always essential to read the fine print or consult with a dental professional to gauge the extent of your coverage accurately. Here at Wilshire Smile Studio, we understand the financial complexities of dental procedures.

We’re committed to helping you optimize your insurance benefits and offering a range of customized financing options to ensure premium dental care remains within reach for everyone.

Remember, the journey to a perfect smile may require an investment, but the resulting boost to your confidence, comfort, and overall oral health is truly priceless.

Consult with our team at Wilshire Smile Studio today, and let’s explore together the best pathway to your most radiant smile. 😄

Secure your oral health today by booking a free consultation with us online or calling (323) DENTIST (323-336-8478)

Frequently Asked Questions

1. Does insurance typically cover dental implants?

Insurance coverage for dental implants can vary. Some dental insurance plans may cover a portion of the cost of dental implants, while others may not provide any coverage at all. It’s best to check with your insurance provider to understand the specifics of your coverage.

2. What factors determine insurance coverage for dental implants?

Insurance coverage for dental implants can depend on factors such as the type of dental insurance plan you have, any exclusions or limitations listed in your policy, and the reason for needing dental implants (e.g., cosmetic or restorative). It’s important to review your insurance policy or contact your provider for accurate information.

3. Are there any alternative insurance options for dental implant coverage?

If your dental insurance does not cover dental implants or provides limited coverage, you may consider supplemental dental insurance with implant coverage, dental savings plans, or financing options offered by dental clinics or implant specialists. Exploring these alternatives can help offset the costs of dental implant treatment.

4. How much of the cost of dental implants does insurance typically cover?

The amount of coverage provided by dental insurance for dental implants can vary widely. Some plans may cover a percentage (e.g., 50%) of the cost, while others may have a fixed dollar amount or annual maximum. It’s crucial to review your insurance policy or contact your provider to determine the coverage details.

5. Is it possible to get pre-authorization from insurance for dental implants?

Yes, it is recommended to seek pre-authorization from your insurance provider before undergoing dental implant treatment. This can help you understand the extent of your coverage, any out-of-pocket costs, and any specific requirements or documentation needed for reimbursement.